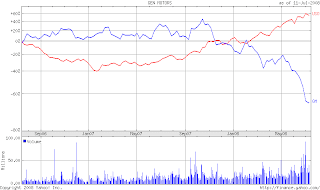

Now looking at General Motors. This chart basically explains everything! The Inverse correlation between GM and OIL (USO in this case).

It's to no surprise right now that GM's gas guzzling vehicle sales are declining in the US due rising gas prices and a struggling economy, however I should note that GM sales rise in Latin America, Africa, Mideast. But today is different than 2006 when GM's stock was under 20 and bonds were at lows, people thought it was a buying opportunity. Well for a while it was, until now when it just hit it's 52 year low. It just broke $10 and is currently at $9.27. Bankruptcy talk is now hitting the headlines by big investment banks, and volatility is very high.

GM Falls to Lowest Since 1974 on Goldman Rating Cut (Update4) Bloomberg, GM Bankruptcy `Not Impossible,' Merrill Analyst Says (Update4) Bloomberg, Investors see higher risk of GM default Reuters.

If I were to take a contrarian view at this moment I think I'd stay away from the common, and look more toward the debt. If GM has a stock offering to raise capital during their restructuring process there would be huge dilution. I believe this news is in process of being priced into the stock but there's too much of a risk that the price could go lower than higher before, I hope, an eventual rebound. However GM could also raise capital in other ways like selling off poor performing brands and getting into the more profitable smaller car/gas efficient space. Eventually oil will come down and housing will bottom in years to come so GM could be a great turn around story if they have liquidity to survive.

The $7 target Merrill put on GM is already implanted into traders minds and could touch that level before traders buy the news. It does seem we are near the point where you could see an eventual top in fear because of the horrible sentiment of bankruptcy and implied volatility is at all time highs and is spiking higher than the historical volatility which means something is going to happen very soon. Once the news is out, and it's a decent restructuring, volatility will be sold hard and we could see a nice rally in the debt and equity. This Implied Volatility chart is supplied by OptionsXpress.

I chose to look at the GM exchange traded notes (debt that trades on the exchanges like a stock), they have been sold off just like the stock, and they're trading lower than they're previous '06 lows. The ETNs look like a better risk/reward right now (if they don't go bankrupt of course) than the common as you get paid north of 15% while you wait for a rebound, and you could possibly dip into the common at a cheaper price.

The GENERAL MOTORS 7.5 SENIOR NOTES(GMS) yield 15.5%, the GENERAL MOTORS 7.375 SENIOR NOTES (HGM) yield 15.9%, and the GENERAL MOTORS 7.25 SENIOR NOTES (XGM) yield 15.6%. Charts by Bigcharts.com.

4 comments:

Regardless of what the nay sayers say, GM will never go bankrupt. You watch, it will be a smaller stronger company. Thanks for the headsup on the the exchange traded notes

why gm stock up, GM bonds still falling. Anybody got a clue. Yes, I know GM could default on interest payments, but no way would common get a dime before bonds are paid. I own BGM and the yield is about 25%. Crazy???

yea you'd think the equity would be falling, because debt just converted to equity yesterday.

"General Motors Corp. (GM) said Monday that it issued 16 million common shares in exchange for $176,417,800 principal amount of its 1.5% series D convertible senior debentures due 2009."

I'm sure the gov loans will be in front of the unsecured senior etn's in a bankruptcy, still you're right the equity should be dying first. Perhaps forced selling somewhere?

Post a Comment