(Source: bigcharts.com)

I'm trying to figure out the logic behind the debt and equity trade. I know the ETN's are unsecured, but still the senior unsecured's would be higher up on the entitlement ladder than the common equity during a reorg or liquidation. So why is the retail debt being sold off more than the common stock? In the debt's case, I'm thinking the $25 Billion Government loans are more senior than the unsecured retail debt, and without the $700 Billion bank bailout auto lending would remain frozen. Looking at the numbers ended 6/30/08, GM had a net worth of -$57 Million, with $74.5 Billion in current liabilities, $35.2 Billion in long term debt and $81 Billion in "healthcare/pension/other liabilities". Adding $8.3B loan to the debt load would probably put the $4.7B of total ETNs at risk of recovering capital in bankruptcy. Also a week earlier GM tapped $3.5 Billion from it's existing credit line, which shows they're still desperate for cash.

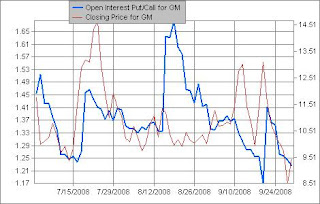

But none of this makes sense because the equity is not pricing in this risk, even though it did touch a new all time low of $8.51 when the market lost 777 points yesterday. GM closed at $9.45 today, unchanged from the mid July lows. Also GM flipped over it's balance sheet these past few weeks by diluting common equity to pay down debt. GM was able to issue 44.3 Million shares to exchange for the $498.3M principal on their Series D Senior Convertable Debentures due 6/09. The fact that this institutional buyer would exchange hundreds of millions of debt for equity at this point is basically saying there's a light at the end of the tunnel for the common shareholders. SEC Filings (9/19, 9/29). GM also plans on raising $2-4B to boost liquidity by selling off assets including the Hummer Brand, Strasbourg manufacturing operations and land. Looking at Schaeffers Research volatility and options data during the past 21 days, GM volatility spiked to all time highs this past week, the Put/Call volume ratio increased from .93 to 1.07, and the Put/Call open interest ratio stayed relatively stable at 1.23 which is a slightly bearish bias. Put open interest and volume actually spiked on 9/22 but tapered off since then. The short interest chart has also been correcting. So there's a tug-of-war going on between positive and negative sentiment, and it could be that GM volatility will ultimately be sold and the stock bought in the short term if congress gets the bail out package passed, however a spike in option volume could go in either direction. So are these retail bond holders dumping to take the loss to load up on the common, are they forced institutional sellers, or are they seeing a bankruptcy hearing around the corner??? We'll see..

0 comments:

Post a Comment