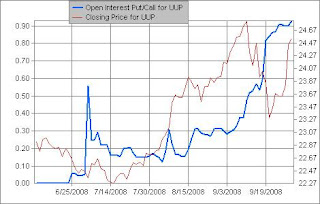

However, during the past month of September, put/call volume has been increasing, as well as the put/call open interest ratio which shows the presence of bears. Plus the Schaeffer's volatility measure is moving higher and there's a load of shorts.. Will call volume spike and UUP break out of resistance????? We'll see how UUP reacts to the house vote.

UUP Put/Call Volume Trend

UUP Schaeffers Volatility Index

3 comments:

I found your blog by going to the UUP message board on yahoo. I wonder why there isn't more activity there? I follow the dollar because I'm investing in commodity related stocks. The option action on UUP is a very interesting angle on where the dollar might be going. It seems that a lot of people have no idea where it's going. I have been going to http://www.learncurrencytrading.com/fxforum/eur-usd/13856-discuss-eur-usd-news-dailyfx-analyst-693.html to read up on trader talk lately on the EUR/USD but they all seem to be very short term traders. Thanks for more of a long term view. Please visit my blog and leave a comment. I'll be checking back.

Yea I'm thinking the dollar strength/commodity fall is tied to the fear of global growth slowing, and I think that is trumping the possible massive printing press inflation that could occur, and $700B to $1Trillion will just add to our country's debt which could touch the $10 Trillion mark, look at my previous posts on our national debt, or see the movie I.O.U.S.A. BUT I'm wondering if the House vote passes will that kill the USD rally. Also the major US indices are trading right at the 15 year trend line (’94 and ’02 lows http://distressedvolatility.com/2008/09/long-term-dow-s-technicals-near-term.html) and look what Warren Buffett is doing he’s buying $GS and $GE while the Dow hits a new low of 10,365. If congress can’t pull something together to put confidence back into the system, not sure how low this could go. Warren believes they will do the right thing...

The dollar rally could feasibly stop when the bailout is passed as a sort of buy the rumour, sell the news scheme. There is some talk about the Euro being very weak on the GLD message board which I visit every day, many times a day. If you know of any message boards on Yahoo that talk about the dollar/euro please let me know. There is nothing going on in the UUP board.

I also read that the bailout will dilute the dollar by 6%. With our negative "real interest rate" this will only add fuel to the fire. I'm reading that we should start gauging the dollars strength against the yen instead of the euro now. Thanks for stopping by my blog. I just posted some big news, if you'd like to check it out. I'm also going to do a "recommended blogs" post and will put a link to yours on there. If you feel like reciprocating, we would both get some more exposure.

Cheers,

JW

Post a Comment