At 1:52am, the Nikkei is down over 10%, and overnight Dow and S&P futures are down 1.6%, and 1.8%.

Thursday, October 16, 2008

S&P 500 Technical Update, New Low To Test 839.80, VIX Needs 750mg Benzodiazepine

Between 900 - 1000 in the S&P has been the range where most of the extremely volatile swings have occurred recently. Today it closed right at the lows of the range, 907. If 900 is breached we touch 839.80, or the capitulation point we saw last week. It could happen again given today's volatility levels. Also the Relative Strength Index tested the July lows under 30 last week. It bounced above 30 recently following the upside in the S&P, however it could retest those lows. Usually when the RSI is under 30 continuously it means we're oversold. Surprisingly the Money Flow Index has not put in a new low since July and could be diverging with the S&P on a 4 month basis. On a monthly basis it looks like the S&P 500 is oversold on a technical standpoint. However since the volatility index increased 25% today to 69.25 and the S&P was down 9%, until things simmer down, technical indicators (longer than 5 minutes) will not be able to guide this market. This market needs a daily 750mg dose of Benzodiazepines to calm it down at this point. Hopefully these liquidity injections by the Fed will do the job, and the VIX will double top from here. We’ll see.

At 1:52am, the Nikkei is down over 10%, and overnight Dow and S&P futures are down 1.6%, and 1.8%.

S&P 500 Index (Source: Stockcharts.com)

VIX Index (Source: Yahoo Finance)

At 1:52am, the Nikkei is down over 10%, and overnight Dow and S&P futures are down 1.6%, and 1.8%.

Monday, October 13, 2008

Jefferson County, AL - Possibility of Biggest Municipal Bankruptcy In History

And you thought the sub-prime mortgage market was bad, take a look at Jefferson County, AL. Yea a county, which is supposed to act like a low risk muni-bond credit. Turns out Jefferson County made some risky interest rate swap transactions against $3.2 billion of debt originated mostly by J.P Morgan. In the early 1990s Jefferson County had sewage problems and was sued by it's residents, so it was forced to incur fixed rate debt backed by sewer/water revenues to rebuild the infrastructure. The financial problems started when the County took advice from J.P Morgan to refinance their fixed rate debt into variable rate and auction debt, or long term bonds auctioned off on a short term basis (weekly to monthly) which kept interest rates low. The County also bought interest rate swaps as a hedge against their variable rate debt, which would indirectly create a fixed-rate bond (bank pays County 1-Month Libor, County pays bank fixed rate on swap). Later on the County even got cash up front by structuring a swap where both parties were obligated to pay a % of 1-Month Libor, with the bank adding .49%. (read the Bloomberg article below). This was all done for large unnecessary fees ($100 Million) to the bank, which could have been used to pay down their debt!.

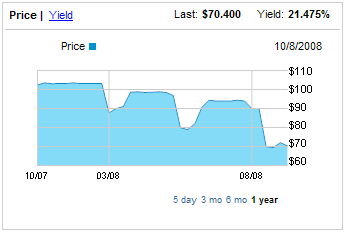

In early 2008, the sewage hit the fan when the auction rate market froze and banks refused to be the buyers of last resort which caused interest rates to double. On top of that, Moody's and S&P downgraded the County's insurance company FGIC that insured the bonds, which in turn forced investor liquidations and boosted rates even higher. And to finish it all off Moody's and S&P cut Jefferson County's debt rating to junk due to their debt service coverage issues. Eventually Jefferson County couldn't pay their interest payments and defaulted on billions of dollars now owed to swap obligees, and debt holders through insurers. Weren't those interest rate swaps supposed to hedge against interest rate risk? The swaps were not protecting against default or marketability (failed auction) risk which spiked up their interest costs. The swaps were protecting against floating market rate risk since the County refinanced into variable rate debt. In Feburary of 2008, floating market rates were actually moving lower while Jefferson County's interest rates were spiking, so the hedge worked against them. Below is a chart of one of the sewer bonds which is distressed yielding 21%. More information on this sewer bond can be found at finra.org. (Sources: Bond Buyer, Businessweek, Bloomberg, BusinessStandard).

Jefferson County, AL Sewer Revenue Capital Improvement Bonds

As of 10/8/2008 (Last Sale) - Finra.org

It's also interesting that it looks like both the banks and the County are trying to hold off a bankruptcy court hearing for as long as they can, and from this article it looks like Jefferson County is trying to squeeze tax revenue from other sources.

Here's a 2 part video on BloombergTV interviewing Christopher Taylor, the former Executive Director of the Municipal Securities Rulemaking Board, about Jefferson County, AL.

This story shows that even municipalities are falling victim to the lax lending standards and risky derivatives originated in the early early 2000s. My next post will look at Municipal Bond Indexes and ETFs to watch.

In early 2008, the sewage hit the fan when the auction rate market froze and banks refused to be the buyers of last resort which caused interest rates to double. On top of that, Moody's and S&P downgraded the County's insurance company FGIC that insured the bonds, which in turn forced investor liquidations and boosted rates even higher. And to finish it all off Moody's and S&P cut Jefferson County's debt rating to junk due to their debt service coverage issues. Eventually Jefferson County couldn't pay their interest payments and defaulted on billions of dollars now owed to swap obligees, and debt holders through insurers. Weren't those interest rate swaps supposed to hedge against interest rate risk? The swaps were not protecting against default or marketability (failed auction) risk which spiked up their interest costs. The swaps were protecting against floating market rate risk since the County refinanced into variable rate debt. In Feburary of 2008, floating market rates were actually moving lower while Jefferson County's interest rates were spiking, so the hedge worked against them. Below is a chart of one of the sewer bonds which is distressed yielding 21%. More information on this sewer bond can be found at finra.org. (Sources: Bond Buyer, Businessweek, Bloomberg, BusinessStandard).

As of 10/8/2008 (Last Sale) - Finra.org

It's also interesting that it looks like both the banks and the County are trying to hold off a bankruptcy court hearing for as long as they can, and from this article it looks like Jefferson County is trying to squeeze tax revenue from other sources.

October 13, 2008

"Jefferson County commissioners spar over sewer debt solutions

A Jefferson County commissioner in favor of bankruptcy said today that bringing an opposing sewer debt rescue plan to the state Legislature will draw gambling into the solution talks. Commissioner Jim Carns, who favors declaring Chapter 9 bankruptcy, said Commission President Bettye Fine Collins "better be careful" moving forward with a plan to get legislative approval for using excess education sales tax money toward reducing the $3.2 billion debt. "Because if it goes to the Legislature, gambling will be part of the scenario, in my opinion," Carns said. Carns comments followed a committee meeting earlier today and touched off the latest controversial exchange between commissioners at odds over solutions to county's sewer debt crisis." Source Al.com

Here's a 2 part video on BloombergTV interviewing Christopher Taylor, the former Executive Director of the Municipal Securities Rulemaking Board, about Jefferson County, AL.

This story shows that even municipalities are falling victim to the lax lending standards and risky derivatives originated in the early early 2000s. My next post will look at Municipal Bond Indexes and ETFs to watch.

Friday, October 10, 2008

Overnight LIBOR rate drops 51% to 2.469%, It's a Start!

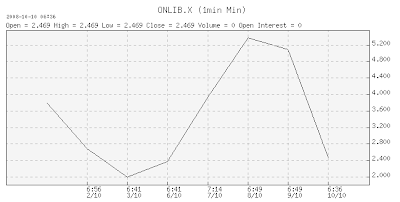

Overnight LIBOR rates dropped 51% this morning to 2.469%, down from 5.09% yesterday. This is a good sign. It's a start, next we need to see a correction in the 3-month LIBOR rate, which actually increased 1.4% to 4.82% this morning. Hopefully the overnight improvement will feed into longer term paper and stabilize these crazy credit markets!

Overnight LIBOR Rate (Source: Tradesignals.com)

You can find LIBOR quotes at cnbc.com, or you can find rates and charts at tradesignals.com you might need to register.

You can find LIBOR quotes at cnbc.com, or you can find rates and charts at tradesignals.com you might need to register.

Thursday, October 9, 2008

Inter-Bank Lending Pressures Continue (Libor Rates), Even With Central Banks Performing Surgery..

Looking at what's going on in the inter-bank lending and forex market is really interesting. I never thought it would come down to a global funding freeze. Money flow is like blood flow, blood is needed to transfer important nutrients to cells, money is needed for the transfer of goods and services between businesses and people. Without the availability of short-term credit (1-mo., 3-mo.) by lending institutions, the problem trickles down to every company needing immediate liquidity to fund payrolls and day-to-day expenses. This is happening right now. With the fall of Lehman Brothers and so many others on the brink of nationalization, lending between banks have frozen up due to this insolvency exposure risk. Nobody knows who is infected which is the reason why Libor rates spiked. Also, the inter-bank lending pressure has hurt those in need of U.S Dollars, which could be part of the reason why the value of the U.S Dollar has increased (lack of supply and institutional hoarding). This forced institutions in need of $US to go out into the forex market and bid it up. Since this continued pressure will have a drastic impact on our economy, the Fed is trying to relieve this pressure by funding 3-month commercial paper directly, lowering the fed funds rate and maybe even taking direct stakes in banks. The Libor rate usually is in lockstep with the fed funds rate, but they've diverged significantly which is a big concern. Plus lowering the Fed funds rate won't work if there's no lending going on, it could spark confidence but a recession would just counteract that effect. Once credit is able to flow again to mid-prime borrowers the crisis will be solved. With the Fed performing 3 day's worth of surgery, 1-month and 3-month Libor rates still haven't come down. Banks are just flat out scared to provide capital. But since there is a lag effect to the fix, here is an optimistic view, along with 1-mo and 3-mo Libor 10 day libor charts below. The carry trade unwinding is also an interesting story, stay tuned.

1 Month Libor Rates (10 Day Chart) - Source: Tradesignals.com

3 Month Libor Rates (10 Day Chart) - Source: Tradesignals.com

"Source: Banks borrow record $420 billion per day from Fed (Reuters, 10/9/2008)

"The Fed's various measures have not been quick fixes for the CP market, but they will eventually help. "People act on a lag. It's not a night-and-day difference," said Deborah Cunningham, chief investment officer for Federated Investors' taxable money markets, on Wednesday. "But people are gaining confidence and that confidence is what is needed to restore normal operations, and it's coming back slowly.""

3 Month Libor Rates (10 Day Chart) - Source: Tradesignals.com

Subscribe to: Posts (Atom)